Pocket Option Predictions: Your Guide to Successful Trading

If you’re looking to navigate the world of online trading, specifically with Pocket Option, it’s essential to have an arsenal of reliable tools and strategies at your disposal. This article aims to provide valuable insights into making effective Pocket Option predictions прогнозы на Pocket Option and enhancing your trading experience. In an industry where informed decisions can lead to profitable outcomes, understanding how to predict market movements can be your key to success.

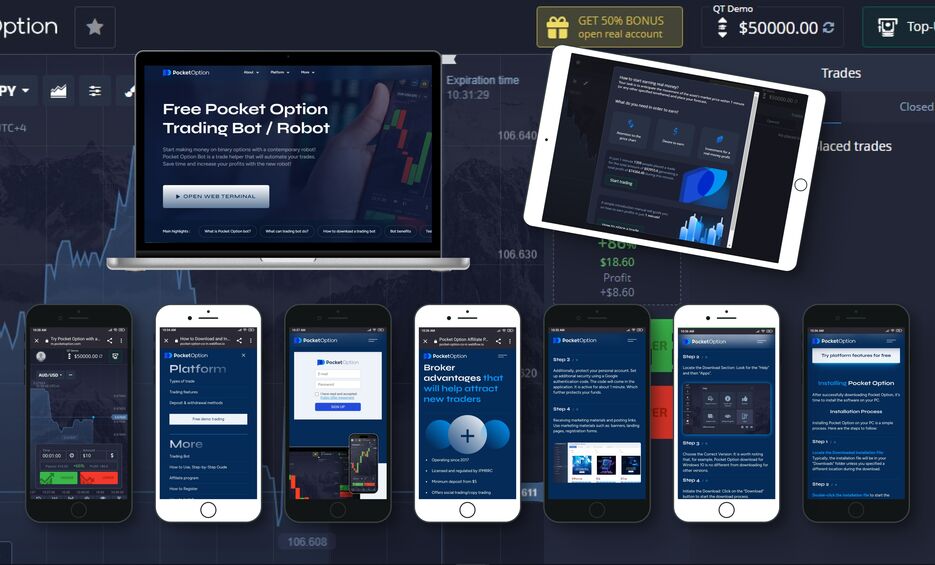

Understanding Pocket Option

Pocket Option is a popular trading platform that allows individuals to trade binary options. It’s known for its user-friendly interface and a variety of assets to choose from, including cryptocurrencies, stocks, commodities, and forex pairs. Since its inception, it has attracted both novice and experienced traders thanks to its accessible features, comprehensive educational resources, and customer support. However, even with its advantages, traders must recognize the risks involved and the need for predictions to guide their decisions.

The Importance of Predictions in Trading

In the world of trading, predictions are vital. They help traders anticipate market movements and decide when to enter or exit a trade. Understanding market trends, patterns, and external factors influencing prices is crucial. Predictions can be based on various methods, including technical analysis, fundamental analysis, and market sentiment analysis. Each approach has its intricacies that traders need to grasp to enhance their accuracy in forecasting outcomes.

Technical Analysis: A Key Method for Predictions

Technical analysis involves evaluating price charts and indicators to predict future price movements. Traders analyze historical data, focusing on patterns that repeat themselves under similar market conditions. Commonly used indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. Learning how to interpret these tools effectively can greatly improve your prediction skills. For instance, a trader may observe a bullish trend with consistently rising moving averages, signaling a potential upward price movement.

Fundamental Analysis: Understanding Market Drivers

On the other hand, fundamental analysis focuses on economic indicators, news events, and overall market conditions. Traders who rely on this method evaluate the underlying factors that might affect an asset’s value. For instance, significant economic announcements, geopolitical events, and changes in regulation can have profound effects on market prices. By staying informed and understanding the implications of such news, traders can make more informed predictions about potential market movements.

Utilizing Market Sentiment for Predictions

Market sentiment is another essential component to consider when making Pocket Option predictions. This involves understanding how emotions and psychology influence traders’ decision-making processes. Tools such as sentiment indicators can help gauge whether the market is bullish or bearish. By analyzing how other traders perceive the market, you can refine your trading strategies and potentially identify lucrative opportunities.

Developing a Prediction Strategy

To enhance your trading performance on Pocket Option, developing a structured prediction strategy is imperative. This framework should encompass elements from technical and fundamental analysis, integrated with market sentiment evaluation. Here’s a simplified approach to developing your prediction strategy:

- Market Research: Dedicate time each day to research current trends, news, and market reports that impact your chosen assets.

- Data Analysis: Use historical price data and employ technical analysis tools to identify potential entry and exit points.

- Risk Management: Implement risk management strategies, such as setting stop-loss orders, to protect your investments.

- Continuous Learning: Trading markets are ever-evolving. Invest in education to keep your skills sharp and stay abreast of the latest developments.

Leveraging Technology for Better Predictions

In today’s trading landscape, technology offers several tools to help traders make informed predictions. Various platforms and applications provide real-time data, automated analysis, and alerts on significant market events. Utilizing trading bots or algorithmic trading systems can also enhance your predictive capabilities by analyzing vast amounts of data much quicker than a human can.

Keeping Emotions in Check

One of the most significant obstacles traders face is managing emotions. Fear and greed can cloud judgment, leading to poor decision-making. Maintaining a disciplined approach to trading and adhering to your prediction strategy is critical. Establishing clear guidelines for when to enter or exit a trade based on your predictions will help you remain consistent and prevent emotional trading.

Conclusion: Making Informed Pocket Option Predictions

In conclusion, successful trading on Pocket Option hinges on the ability to make informed predictions. By utilizing a combination of technical and fundamental analysis, along with an understanding of market sentiment, traders can significantly enhance their forecasting abilities. Moreover, taking advantage of technological tools and maintaining emotional discipline will lead to better trading outcomes. As you embark on your trading journey, remember that continuous learning and adaptation are vital to navigating the increasingly complex trading landscape.

With these strategies in mind, you can maximize your potential for success in trading on Pocket Option and enjoy a more profitable trading experience.